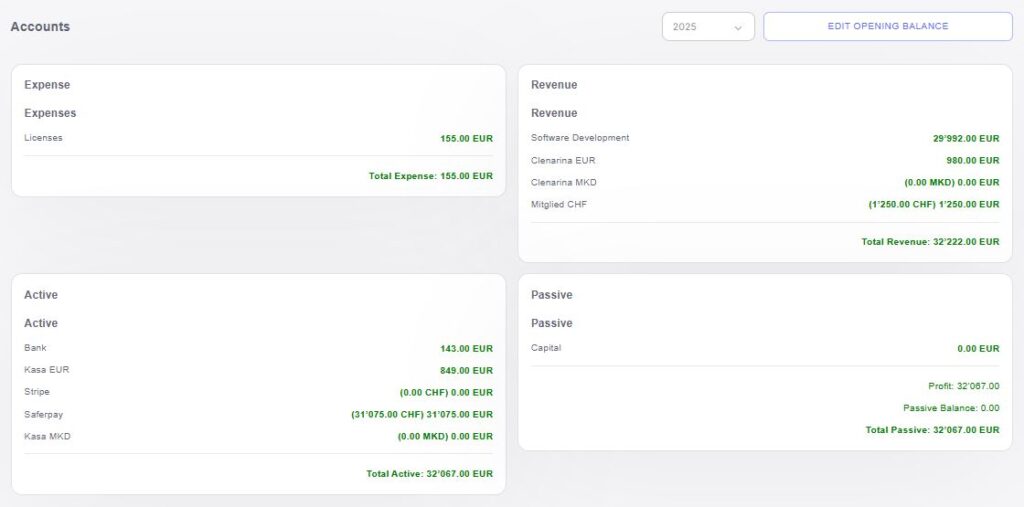

The Accounts feature in your ERP system helps you efficiently manage and track your financial data, giving you a clear overview of your business’s financial health. With dedicated fields to record and monitor your expenses, revenue, and other financial categories, this feature streamlines your accounting processes, providing more transparency and control over your finances.

Expenses

The “Expenses” field allows you to track all outgoing costs associated with your business operations. By recording and categorizing expenses, you gain insights into areas where you’re spending and can identify opportunities for cost reduction. This feature ensures that your accounting records are accurate and up-to-date, supporting better financial planning and budgeting.Revenue

The “Revenue” field enables you to track all incoming money, such as sales income or other forms of revenue. Monitoring your revenue helps you understand the financial performance of your business, identify trends, and ensure that your earnings align with business goals. This field is essential for calculating profitability and financial forecasting.Active

The “Active” field represents your current, operational financial accounts. These are the accounts that are actively being used to manage your business’s daily transactions. By tracking active accounts separately, you can easily distinguish them from accounts that are inactive or no longer in use.Passive

The “Passive” field tracks accounts that are not actively being used or are in a dormant state. These accounts may represent long-term liabilities or accounts that are temporarily inactive. Keeping track of passive accounts helps you manage your financial structure and provides clarity on any financial obligations or dormant assets.

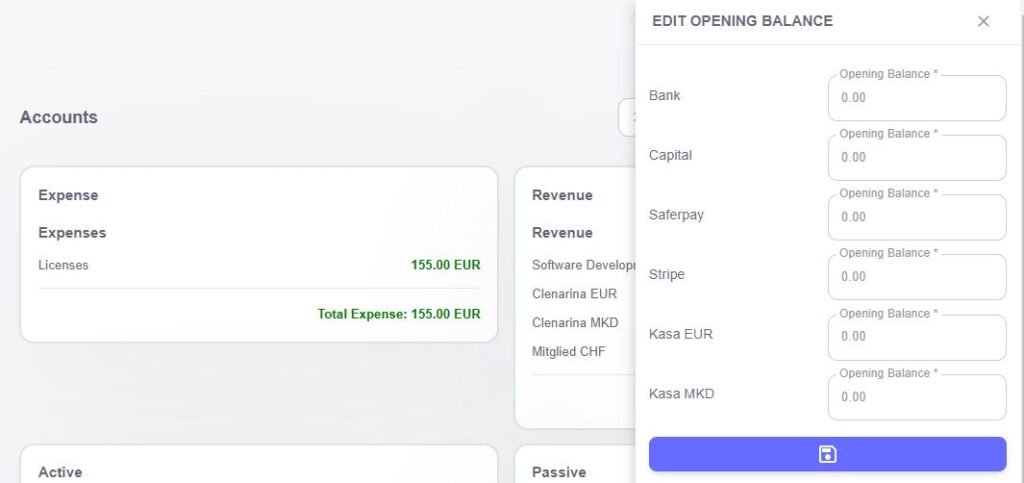

The Edit Opening Balance feature in your ERP system allows you to easily manage and update the starting balances for your financial accounts. This is an essential tool for businesses that need to adjust their financial records when transitioning to a new period or correcting any discrepancies in their opening balances. By editing these balances, you can ensure that your accounting data is accurate from the outset.

Bank

The “Bank” field allows you to set or update the opening balance for your business’s primary bank account. By accurately entering the starting balance, you ensure that all subsequent transactions align correctly with your financial records, providing a clear view of your cash flow.Capital

The “Capital” field lets you define the opening balance for your business’s capital account. This is important for tracking your initial investment and the financial foundation of your business. Adjusting the capital balance ensures that your equity records are up-to-date and accurately reflect the resources invested into the company.Saferpay

The “Saferpay” field allows you to set the opening balance for your Saferpay account, which may be used for online payments or transactions. Ensuring that the balance is correctly reflected helps track digital payments and reconcile financial transactions across various platforms.Stripe

The “Stripe” field is used to define the opening balance for your Stripe account, commonly used for processing online payments. Accurate tracking of your Stripe balance is essential for managing payments, refunds, and processing fees, keeping your records aligned with your business transactions.Kasa EUR

The “Kasa EUR” field lets you specify the opening balance for your cash account in Euros (EUR). This is useful for businesses that deal with multiple currencies, as it helps maintain accurate cash flow records and ensures that transactions in Euros are correctly reflected in your system.Kasa MKD

The “Kasa MKD” field tracks the opening balance for your cash account in Macedonian Denar (MKD). By accurately setting this balance, you can ensure proper management of your local currency transactions and keep your financial reporting consistent across multiple currencies.