The Journal feature in your ERP system provides a comprehensive way to record and manage all financial transactions within your business. By capturing key information for each entry, this feature ensures accurate bookkeeping, streamlined accounting processes, and enhanced financial reporting.

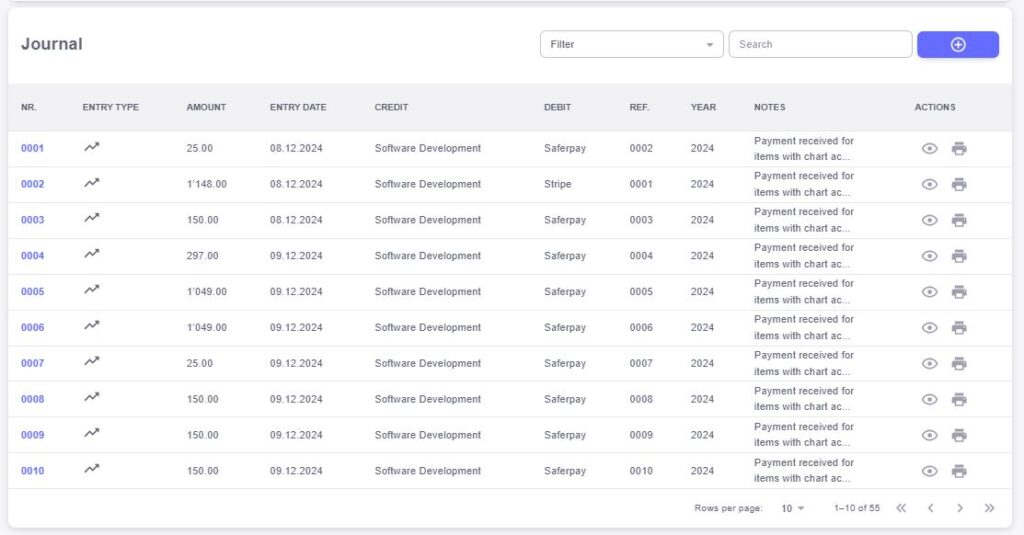

Nr.

The “Nr.” field assigns a unique identification number to each journal entry. This reference number makes it easier to track, search, and cross-reference specific transactions, improving overall organization and accessibility within your accounting records.Entry Type

The “Entry Type” field specifies the nature of the transaction. Whether it’s a general journal entry, an accrual, adjustment, or any other financial activity, this field categorizes the transaction for better organization and reporting. Identifying entry types helps differentiate between various accounting actions and ensures consistency in your records.Amount

The “Amount” field represents the monetary value associated with the journal entry. Whether it’s a credit or debit, this field shows the financial impact of the transaction and helps you maintain accurate account balances.Entry Date

The “Entry Date” field marks the date when the journal entry was created or recorded. This ensures proper time-tracking of financial activities and helps maintain the chronological order of transactions, making audits and financial reviews simpler and more efficient.Credit

The “Credit” field records any amounts added to accounts, indicating an increase in assets or income. This field helps track positive financial transactions that contribute to the growth of your business, such as incoming payments, deposits, or transfers.Debit

The “Debit” field tracks any amounts deducted from accounts, representing expenses or liabilities. This field allows you to monitor outflows, payments, and withdrawals, ensuring you have a complete and accurate financial record.Ref.

The “Ref.” field provides a reference or identifier for the journal entry, such as invoice numbers, transaction IDs, or related documents. This ensures that each journal entry is traceable to its source and helps maintain accuracy when reconciling or auditing financial data.Year

The “Year” field categorizes the journal entry based on the year it was recorded. This is essential for year-end reporting and financial analysis, allowing you to quickly identify transactions by their respective fiscal periods.Notes

The “Notes” field allows you to add any additional details or context about the journal entry. This could include descriptions, reasons for the transaction, or other relevant information that can help clarify the nature of the entry for future reference or auditing.Actions

The “Actions” field provides quick access to essential functions related to each journal entry, such as edit, delete, or view. This feature allows you to manage your journal entries efficiently, ensuring your financial records are always up-to-date and accurate.

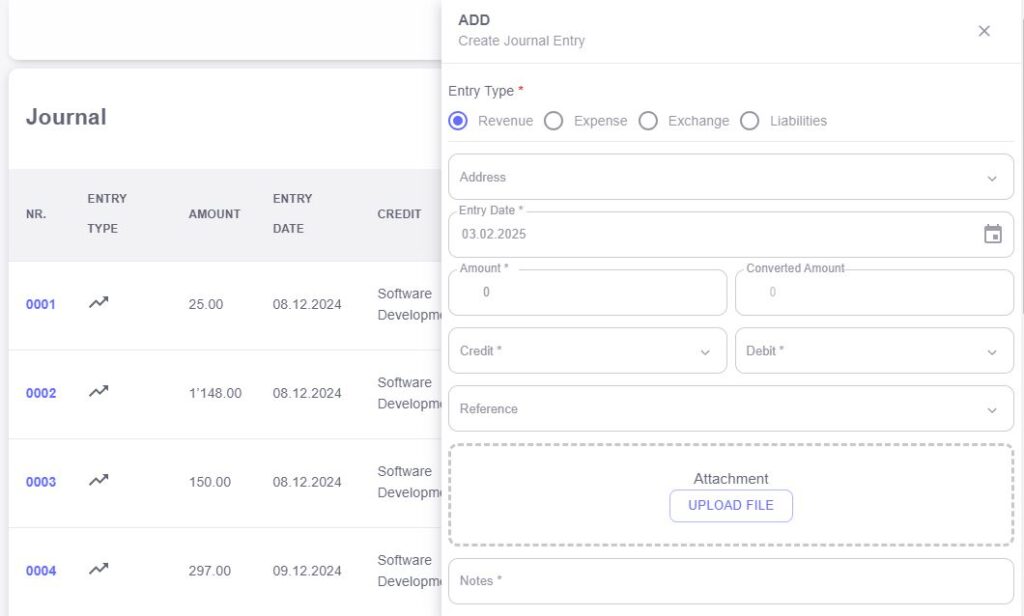

The New Journal Entry feature in your ERP system provides an easy and efficient way to record financial transactions as they occur. By filling in the relevant fields, you can ensure that every entry is accurately captured, organized, and linked to your overall financial records. This feature helps maintain transparency and precision in your accounting process.

Entry Type

The “Entry Type” field allows you to categorize the type of transaction you’re recording. Whether it’s a payment, transfer, accrual, or other financial action, selecting the correct entry type helps maintain organized records and ensures the right accounting procedures are followed.Address

The “Address” field allows you to enter any relevant address information related to the transaction. This can be helpful for linking physical locations to certain entries, particularly for transactions involving shipments, billing, or other location-specific activities.Entry Date

The “Entry Date” field records the date the journal entry takes place. This is crucial for maintaining accurate chronological records of your financial activities, which is essential for reporting, audits, and financial analysis.Amount

The “Amount” field captures the total value of the transaction being recorded. This is the monetary amount associated with the journal entry, whether it’s a payment, receipt, or transfer.Converted Amount

The “Converted Amount” field is useful if the transaction involves currency conversion. This field reflects the equivalent amount in your system’s base currency after conversion, ensuring that your financial records are consistent and accurate across multiple currencies.Credit

The “Credit” field tracks any positive amounts added to your accounts, such as deposits or incoming funds. This helps maintain accurate tracking of your assets and income.Debit

The “Debit” field records any amounts deducted from your accounts, like payments or expenses. Tracking debits is essential for understanding your outflows and maintaining balanced financial records.Reference

The “Reference” field is where you can add a unique identifier for the journal entry, such as an invoice number, transaction ID, or related document. This ensures that each entry is traceable to its source and makes it easier to link your accounting data to supporting documents.Attachment

The “Attachment” field allows you to upload any relevant documents or files related to the journal entry. Whether it’s an invoice, receipt, or contract, attaching these files ensures that all supporting evidence is stored together with the entry, improving transparency and streamlining audits.Notes

The “Notes” field gives you the option to add additional context or comments about the journal entry. You can use this field to explain the nature of the transaction, provide extra details, or clarify any unique circumstances surrounding the entry.